The allure of cryptocurrency, particularly Bitcoin, continues to captivate investors worldwide, and the UK is no exception. As the digital gold rush intensifies, securing the right mining hardware becomes paramount for those seeking to carve out a piece of the Bitcoin pie. This article delves into the top Bitcoin mining hardware deals currently available for UK-based investors, navigating the complex landscape of ASICs, hash rates, power consumption, and profitability.

Before diving into specific deals, it’s crucial to understand the underlying economics of Bitcoin mining. Mining is essentially a computationally intensive process of verifying and adding new transaction records to Bitcoin’s public ledger, the blockchain. Miners are rewarded with newly minted Bitcoins for their efforts, incentivizing them to maintain the network’s security and integrity. The more powerful your mining hardware, the greater your chances of solving the complex cryptographic puzzles and earning those coveted Bitcoin rewards. The difficulty of these puzzles is adjusted dynamically to maintain a consistent block creation rate, ensuring that the supply of Bitcoin remains predictable and controlled.

The Antminer S19 series, particularly the S19 Pro and S19j Pro, remain dominant forces in the Bitcoin mining arena. These Application-Specific Integrated Circuits (ASICs) are specifically designed for Bitcoin mining, offering significantly higher hash rates and energy efficiency compared to general-purpose computers or even GPUs. The hash rate, measured in terahashes per second (TH/s), indicates the machine’s computational power. A higher hash rate translates to a greater probability of solving the cryptographic puzzles and earning Bitcoin rewards. However, it’s essential to consider power consumption, as electricity costs can significantly impact profitability. The S19 series strikes a good balance between hash rate and energy efficiency, making them a popular choice among serious Bitcoin miners.

For UK investors seeking more budget-friendly options, older generation Antminers like the S17 series or even S9 series might be considered. However, it’s crucial to perform a thorough cost-benefit analysis before investing in older hardware. While the initial investment may be lower, older miners typically have lower hash rates and higher power consumption, potentially leading to lower profitability and even losses depending on electricity costs and Bitcoin price fluctuations. Furthermore, the lifespan of mining hardware is finite, and older machines are more likely to experience downtime and require repairs.

Beyond Antminers, other ASIC manufacturers like Canaan and MicroBT offer competitive mining hardware options. Canaan’s AvalonMiner series and MicroBT’s WhatsMiner series are known for their performance and reliability. It’s advisable to research and compare different models from various manufacturers, considering factors like hash rate, power consumption, price, warranty, and availability. Online mining calculators can be valuable tools for estimating potential profitability based on current Bitcoin prices, network difficulty, and electricity costs.

Another crucial aspect to consider is mining location. The UK’s electricity prices can be relatively high compared to other regions, making it essential to optimize energy consumption and potentially explore mining farm hosting solutions. Mining farms offer professional hosting services, providing a stable and secure environment for your mining hardware, often with lower electricity rates and expert maintenance. These farms typically charge a hosting fee, but the benefits of lower electricity costs, reduced downtime, and expert support can outweigh the costs for many investors.

Alternatively, some investors choose to participate in mining pools. A mining pool is a collaborative effort where multiple miners combine their computational power to increase their chances of solving blocks and earning Bitcoin rewards. The rewards are then distributed among the pool members based on their contribution. Mining pools can provide a more consistent stream of revenue compared to solo mining, but it’s essential to choose a reputable pool with reasonable fees and a transparent payout system.

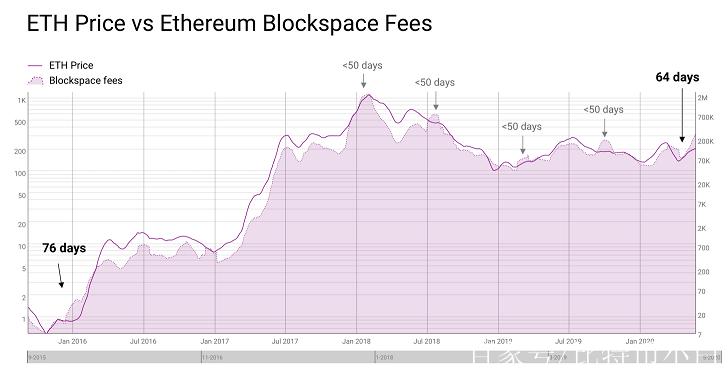

Beyond Bitcoin, some miners explore the possibility of mining alternative cryptocurrencies (altcoins) such as Litecoin, Dogecoin, or Ethereum (although post-Merge, Ethereum mining is no longer possible through Proof-of-Work). However, it’s crucial to understand that the mining algorithms and hardware requirements for different cryptocurrencies vary significantly. ASICs designed for Bitcoin mining are typically not compatible with other cryptocurrencies, requiring specialized hardware like GPUs for mining algorithms like Ethash (used by Ethereum before the Merge) or Scrypt (used by Litecoin and Dogecoin). The profitability of mining altcoins can also be highly volatile, making it essential to conduct thorough research and risk assessment.

Before making any investment decisions, it’s essential to conduct thorough research, seek professional advice, and understand the inherent risks associated with cryptocurrency mining. The Bitcoin mining landscape is constantly evolving, with new hardware innovations and fluctuating market conditions. Staying informed and adapting to these changes is crucial for long-term success in the world of Bitcoin mining.

This article expertly highlights the best Bitcoin mining hardware deals available for UK investors, featuring an array of options that cater to different budgets and technical needs. It delves into the performance, energy efficiency, and long-term profitability of each device, making it an invaluable guide for anyone looking to maximize their mining potential in a competitive market.